Revolut: Disrupting finance services with investor-ready marketing

In just a few short years, Revolut has gone from a UK-based startup to a global fintech leader. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut aimed to disrupt traditional banking with its app-based financial services. By offering seamless currency exchange, free international transfers, cryptocurrency trading, and budgeting tools all in one platform, Revolut provided a modern, customer-centric alternative to outdated banking systems. But behind this meteoric rise lies a carefully crafted marketing strategy that not only drove rapid growth but also attracted billions of pounds in investment.

Let’s explore how Revolut used marketing to secure investor confidence and become one of the most successful fintech companies in the world.

1. Innovation and disruption as the core brand identity

From the outset, Revolut branded itself as a fintech innovator, offering services that traditional banks couldn’t match. The company’s mission was clear: to eliminate the barriers between people and their money, no matter where they were in the world.

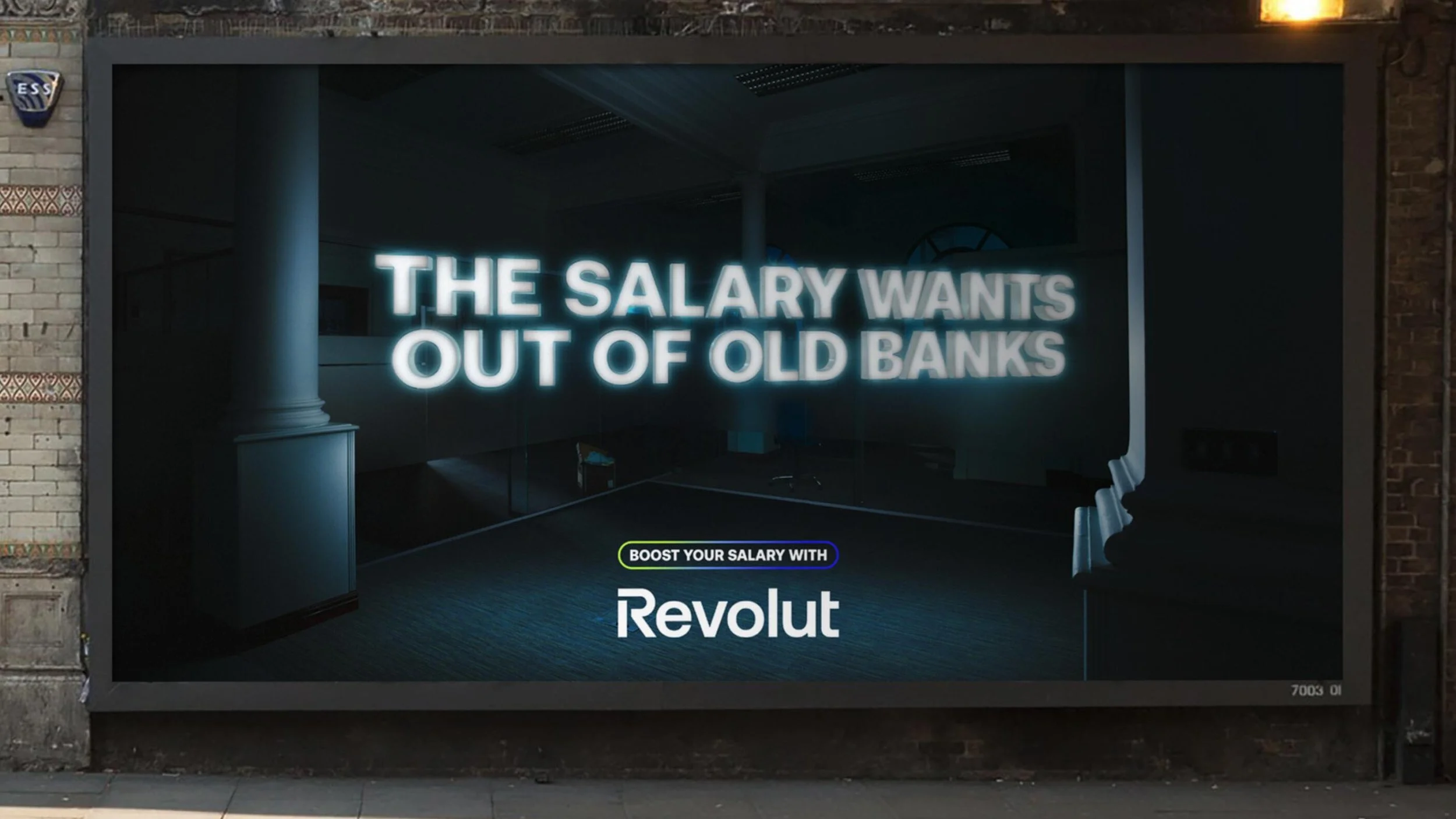

Revolut’s disruptive brand narrative was a key differentiator in a highly competitive industry. Their marketing centered around the idea that traditional banks were outdated, slow, and riddled with unnecessary fees, while Revolut provided fast, efficient, and fee-free services, particularly for travelers and international transactions.

Marketing message:

“The bank that’s not really a bank” – By emphasising its position as an alternative to traditional banking, Revolut attracted users frustrated with traditional financial institutions. It’s a message that resonates well with millennials and tech-savvy consumers who prefer digital-first services.

Global financial freedom – Revolut’s core value proposition of offering seamless global banking services aligned with the needs of a globalised, increasingly mobile world. The ability to make fee-free international transactions and manage multiple currencies was a game-changer for international users.

By positioning itself as a disruptive, forward-thinking company, Revolut made itself highly attractive to both customers and investors. Investors, in particular, were drawn to the company’s potential to revolutionise a traditionally slow-moving sector.

Key Investor Appeal: Investors are drawn to companies that challenge existing systems with innovative solutions. Revolut’s ability to present itself as a challenger to traditional banks attracted major investors, helping the company raise over $900 million by 2020, reaching a valuation of over $5.5 billion.

2. Data-driven growth strategy

At the heart of Revolut’s marketing success is its data-driven growth strategy. Rather than relying on traditional marketing tactics, Revolut focused on testing and optimising every aspect of its user acquisition and retention strategies.

Revolut employed rigorous data analysis to measure customer behavior, acquisition costs, and lifetime value (LTV). This allowed them to continually refine their marketing efforts, ensuring maximum efficiency in reaching and retaining users.

Tactics that stood out:

Referral programs: Revolut used highly effective referral programs to grow its user base. By incentivising users to invite friends and family, Revolut quickly expanded its customer base at a relatively low cost. Their data-driven approach enabled them to continually optimise referral rewards to maximise growth.

In-app engagement metrics: Revolut tracked how users engaged with its app and continually introduced new features to increase engagement and reduce churn. Their data-driven approach meant they could quickly identify what features were most popular and focus marketing efforts on those key areas.

Key investor appeal: Investors want to see that a company is scaling efficiently. By using data-driven marketing to optimise acquisition and retention costs, Revolut was able to demonstrate sustainable growth, helping them secure large-scale investment.

3. Tailored marketing for global reach

Revolut’s global expansion strategy is one of the most impressive in the fintech world. While most companies focus on scaling within their domestic markets first, Revolut’s goal from day one was to become a global financial super-app. To achieve this, Revolut employed a tailored marketing approach, adapting its messaging and offerings to fit each local market while maintaining a consistent global brand.

Global localisation strategy:

Adapting to local markets: As Revolut expanded into new countries, it localized its marketing efforts to appeal to the specific needs of local users. For example, in Europe, Revolut marketed itself as a fee-free option for frequent travelers. In the US, the company emphasised its cryptocurrency trading capabilities, which were becoming increasingly popular.

Multilingual marketing campaigns: Revolut launched marketing campaigns in multiple languages and used local influencers to boost its presence in different countries. By ensuring that its marketing was culturally relevant, Revolut was able to connect with diverse audiences on a personal level.

Key investor appeal: Investors saw Revolut’s ability to scale internationally as a significant advantage. By demonstrating that it could effectively enter new markets while maintaining a strong growth trajectory, Revolut appealed to investors looking for global scalability.

4. Innovative use of social media and digital advertising

Revolut’s marketing strategy is heavily reliant on social media and digital advertising to reach its target audience. Instead of large-scale traditional advertising, Revolut focuses on creating engaging content and using precise targeting algorithms to reach potential customers across digital platforms.

Key Strategies:

Engaging social media presence: Revolut uses social media not just for advertising but as a platform to engage with users. They post regular updates about new features, special promotions, and tips for using the app more effectively. This not only drives user engagement but also creates a sense of community around the brand.

Influencer collaborations: Revolut partnered with social media influencers to promote its services to wider audiences. By collaborating with financial influencers and bloggers, Revolut was able to tap into niche communities and build trust with potential users.

Targeted digital ads: Revolut uses hyper-targeted digital ads across platforms like Facebook, Instagram, and Google. Their ads highlight Revolut’s key features, such as fee-free international transfers and cryptocurrency trading, tailored to the user’s demographic and behavior.

Key investor appeal: A strong digital marketing presence is crucial for scaling in today’s market. Revolut’s mastery of digital advertising and social media engagement showed investors that the company was adept at reaching new customers in a cost-effective manner.

5. Customer-centric product development and marketing

Revolut’s marketing and product development are deeply intertwined. By continually improving its product and introducing new features that directly address customer needs, Revolut is able to stay ahead of its competition and attract investment.

Customer-centric approach:

Listening to feedback: Revolut actively listens to customer feedback and makes adjustments based on user requests. This approach has led to the introduction of popular features like cryptocurrency trading, budget management tools, and a rewards program.

Frequent updates and feature rollouts: Revolut’s rapid development cycle means the app is frequently updated with new features. Each new feature rollout is accompanied by a marketing push that highlights how it benefits users. This keeps users engaged and drives continual growth.

Key investor appeal: A company that listens to its customers and innovates based on their feedback is more likely to retain its user base and keep them engaged. This customer-centric approach was a major factor in Revolut’s ability to secure large investments from venture capital firms like Index Ventures and DST Global.

Revolut’s meteoric rise in the fintech world is a testament to the power of a well-executed marketing strategy. By branding itself as a disruptor, leveraging data-driven growth tactics, expanding globally with tailored marketing, and maintaining a strong digital presence, Revolut has been able to attract billions in investment and secure its place as a leader in financial innovation.

For high-growth companies seeking investment, Revolut offers valuable lessons: focus on innovation, listen to your customers, and use data to guide your marketing decisions. Investors are drawn to companies that can scale efficiently, enter new markets effectively, and continuously engage their users—all hallmarks of Revolut’s marketing success.